Our investor onboarding software

Deliver a seamless digitized investor onboarding process to your clients.

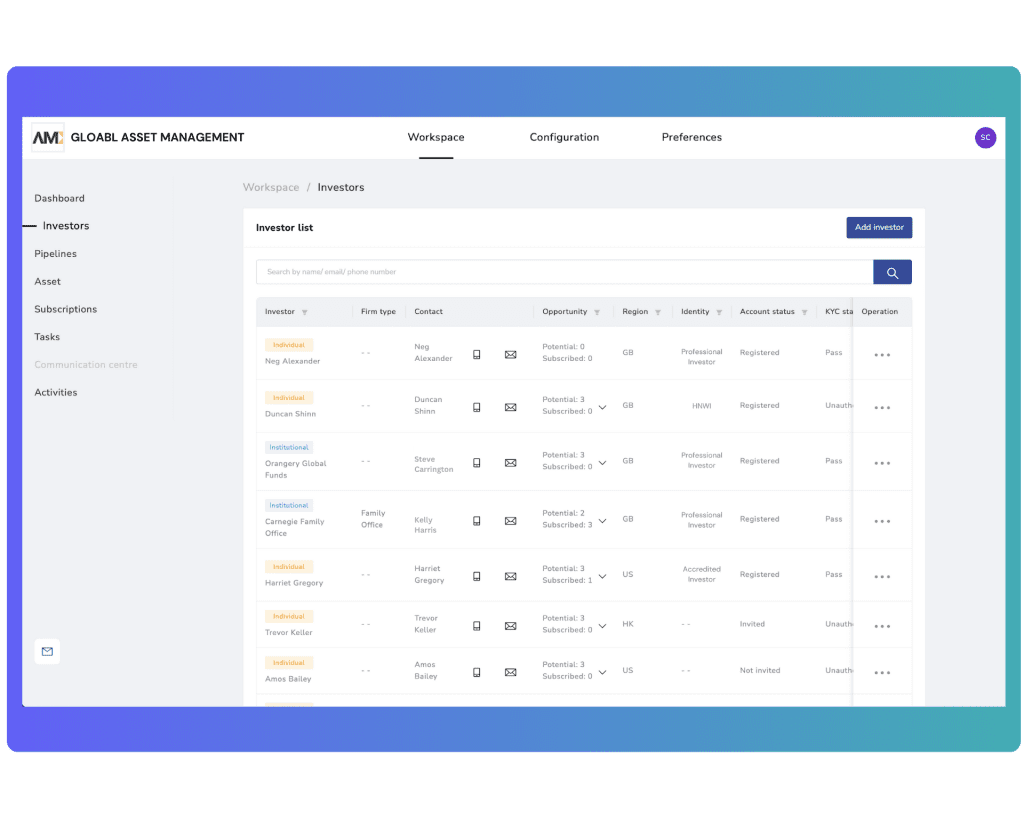

- Investors can create an account and invest easily, with minimal friction as managers can easily monitor their progress with our investor onboarding software

- Multijurisdictional capabilities, catering to all types of investors and geographies

- A fully automated and configurable investor onboarding software that matches your compliance standards

KYC onboarding and AML compliance

Improve the efficiency of the onboarding process, collect investor information, and facilitate the submission, review, and approval of KYC/AML documentation, whilst staying on the right side of regulation.

Easily verify and authenticate the identity of potential investors during the onboarding process.

Ensure compliance with KYC/AML regulations and mitigate the risk of fraudulent activities

Have a comprehensive transaction monitoring system in place to detect any suspicious or potential money laundering activities

Send real-time updates on the results of investors’ KYC/AML reviews so that they can promptly proceed with their investment activities

Keep track of investors who have passed or failed their KYC/AML status

Prevent any investor from investing if their KYC/AML status has been marked as failed

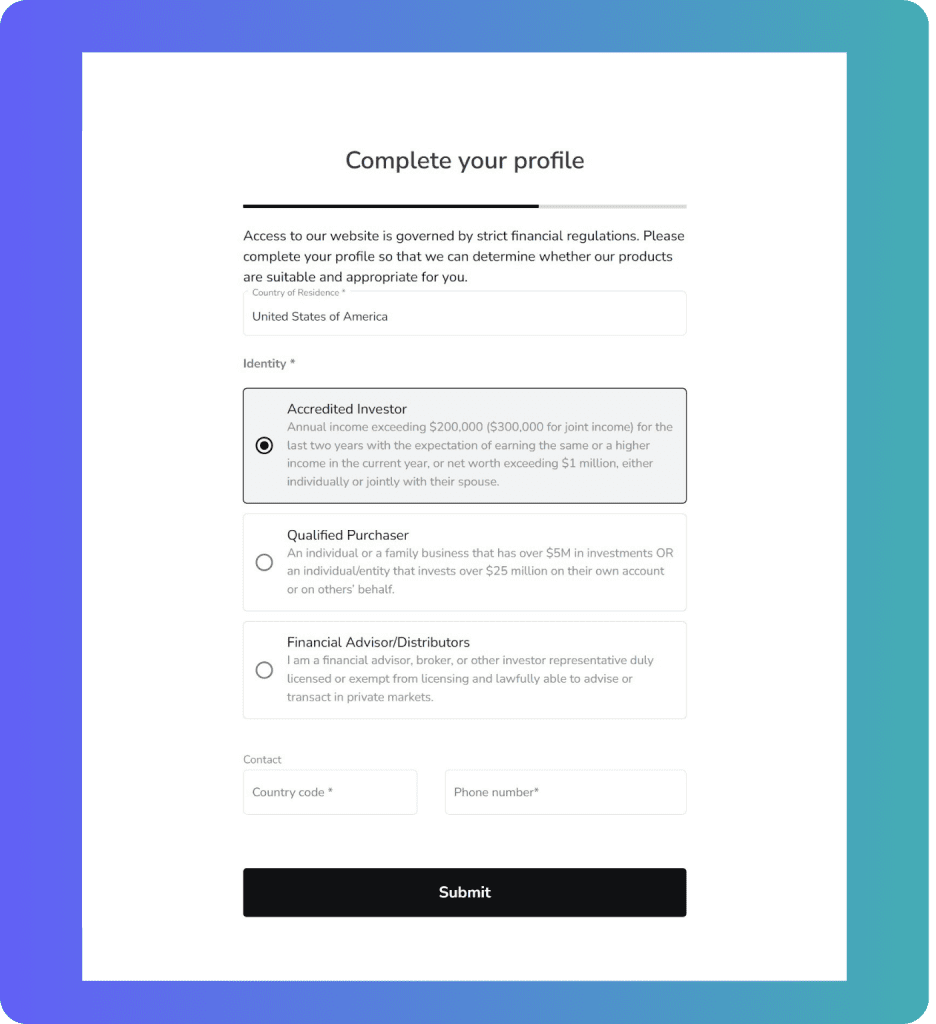

Multijurisdictional regtech

Expand your geographical reach, tap into new markets or strengthen your existing ones with a multijurisdictional onboarding solution catering to all types of investors.

Enable different jurisdictions and types of investors to the site

Offer funds in the right jurisdictions

Easily distribute funds in various jurisdictions

Compliance re-attestation

Speed up processes providing a clear view of investors overdue for a compliance re-check

Set the compliance re-attestation time frame to match your timings

A streamlined and user-friendly onboarding process ensures personal information is secure and confidential during the AML check process

Fund administrators benefit from a full access to comprehensive investor identity & subscription records

Provide investors with transparency into the Annual Compliance process, including the status of Annual Compliance and any additional steps required to complete the process.

Support for your investors’ wealth manager & financial advisors

Save investors time & make their life simpler with Assist Invest.

Assist Invest enables Wealth Managers and Financial Advisors access to the platform on their clients’ behalf so they can:

1

Create investor profiles

2

E-sign sub docs

Are you a wealth manager or advisor?

We are here to help you start investing in alternatives, enhancing your digital capabilities and distribution.

Looking to take gain a further edge? Learn more about our industry disrupting Wealth Management & IRA portals.

Frequently Asked Investor Onboarding Questions

How does Bite Stream streamline the investor onboarding process?

By digitizing the onboarding process, Bite Stream enables users to quickly obtain relevant information from new investors, with all data automatically captured and stored in the systems’ CRM. All members of the fund management team can see and track where in the process each subscription sits, making the process quick and frictionless. Additionally, the modern and seamless experience increases brand loyalty.

Do my investors have to go through the entire process when they reinvest?

No, investors only need fill in the details to the platform once. The platform automatically maps out data for future investments throughout the entire investment process. When investors reinvest, all their information is readily available, significantly expediting the process.

Can our investment platform accommodate for investors globally?

Yes, the platform is accessible to investors globally, leveraging its multijurisdictional and configurable capabilities to align with users’ compliance requirements.

What if my investors don’t want to use digital subscriptions?

To cater to all investor preferences, Bite Stream allows users to upload offline subscriptions to the platform. Additionally, we offer “Assist Invest,” a feature enabling Wealth Managers and advisors to access the platform on their clients’ behalf, create profiles for investment, and e-sign subscription documents.

You may also be interested in

Interested in Bite Stream?

Talk to an expert today