A ‘Bite of Private Markets – delivering Facts, Insights & Strategies

Private Equity on the Rise

Charlie von Moll

Managing Director, Head of Europe

Overview

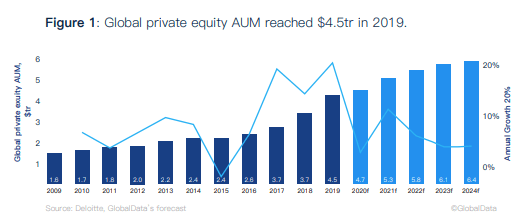

The private equity market is experiencing steady growth. At the end of 2020, assets under management (AUM) were estimated to be at $4.7tr. The latest projections are that private equity AUM will grow to $6.4tr by 2024.

There are several factors driving this growth. For one, the number of high net worth (HNW) individuals has been increasing along with the corresponding wealth. A record 9% CAGR is forecasted for HNW wealth from December 2020 through 2024. Of that wealth, the HNW market is expected to increase private equity allocations by 4.4% by the end of 2021. There are regional differences. For example, HNW investors in the UK are already allocating 8.8% of their portfolios to private equity, while the Chinese HNW investor market is largely untapped with just 2% of the investment portfolio.

What is it that attracts HNW individuals to private equity? Consider that many HNW investors gained their wealth in C-suite roles where they faced multiple risks, ranging from liquidity and market risks to economic risks. By nature, many business owners have a higher risk tolerance than others along with a different perspective on risk and return. As such, they are frustrated with traditional asset classes and are seeking yield. This, coupled with HNW investors’ increased investment sophistication and stronger knowledge of the financial markets, is making them more receptive to new investment strategies wherein private equity has taken a central role.

Behind the Numbers

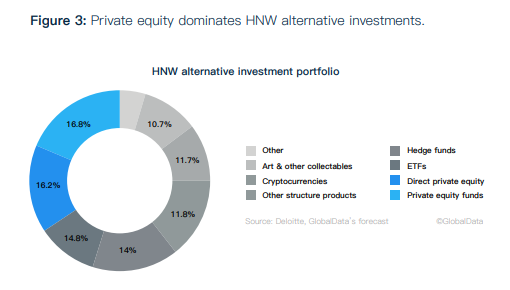

• On a global basis, HNW investors currently allocate 3.4% of their onshore wealth to private equity(i).

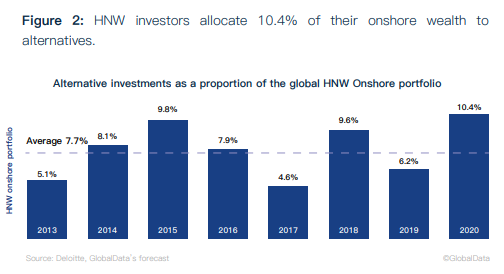

• One tenth of every HNW dollar is allocated to alternative investments onshore; an amount that is expected to increase.

• According to GlobalData’s 2020 Global Wealth Managers Survey, 44.6% of wealth managers expect global HNW demand for alternative investments to rise over the next 12 months. This is in contrast to just 13.4% projecting a decrease.

• Private equity is the dominant alternative investment in HNW portfolios.

• Private equity is believed to be the primary component in private alternatives having tripled over the period from 2007 to 2020, increasing from $2.5tr to $8tr based on data from Blackrock (ii).

Clearly, alternative investments and, in particular, private equity, has captured the attention of HNW investors for multiple reasons: their risk tolerance, increased investor sophistication, disappointment with the low returns from other investments, and a desire for better yields and diversification to help offset market volatility.

Market Challenges

While private equity is in a steady growth period, it is not without challenges. One hurdle that must be overcome is that of getting more wealth managers on board.

At present, only 40% of wealth managers offer private equity investments. This is largely due to the difficulty many investors have accessing alternative investments. For wealth mangers, this challenge is even more pronounced with just a minority of advisers in most markets able to provide access. Typically, access to alternative investments has been confined to private wealth managers serving the institutional markets (i.e., pension funds or sovereign wealth funds).

Another obstacle lies with the onerous due diligence requirements involved with private equity or venture capital funds. These requirements can be so complex that they require the involvement of lawyers and accountants. Adding to the burden of those without digitalized operations, are the paper-based processes involved which require prospective investors to re-key data and information they have already provided to their wealth manager.

The actual size of the investment also has been a deterrent. The minimum investment sizes, typically from $10m, are prohibitive for many HNW individuals. Therefore, despite being qualified as sophisticated investors and accredited, they are unable to gain access as limited partners.

Presenting another challenge is the long lock-up periods many funds require. These periods can range from 10 to 12 years; a duration many HNW investors simply do not want to endure.

Market Opportunities

While some challenges exist, they are being addressed. One trend underway which is transforming wealth management is digitization. It is true that the wealth and investment management industry has been laggards when it comes to adopting digital tools, falling far behind other industries. That is, however, changing.

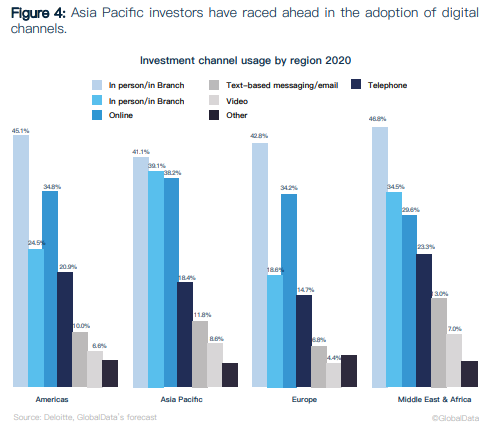

With more investors gravitating toward digital channels, especially the younger “digital native” generations, wealth managers are realising that offering digital platforms will no longer be an option, but rather a necessity. Those professionals that have been viewing and testing different platforms too are learning just how beneficial they can be from a service delivery standpoint. The most advanced of fintech platforms digitize the entire investment process, from client qualification and investment selection, through regulatory and compliance process, know your customer (KYC), anti-money laundering (AML), reporting and due diligence. This frees up the wealth manager to spend more value-added time strengthening their client relationships, rather than on tedious, time-consuming processes.

With a leading-edge platform giving them a competitive advantage, wealth managers will be better positioned to tap into regions where HNW investors are more inclined toward digital interaction. This is true for affluent investors in the Asia Pacific region where the use of mobile apps for interacting with their wealth managers is almost equivalent to in-person meetings.

The digital factor notwithstanding, private equity allocations are already significant in the United Kingdom (8.8%), and Germany (5.3%). In India, these allocations are projected to increase from 5.1% in 2020 to 7.6% in 2021. Chinese HNW investors are currently allocating 2% to private equity, however, that market has been and is growing rapidly.

Leveraging Alternative Investments

For HNW investors and wealth managers alike, alternative investments offer opportunities best captured with the support of digitization and business models that alleviate the traditional obstacles.

New fintech models enables HNW investors and advisors to invest in private equity with manageable investment sizes and lock-up periods and which can be monitored conveniently on user-friendly, robust online platforms.

There also are other new fintech platforms available to wealth managers as white-labelled, in-house solutions or external solutions, both of which offer them efficient access and management of their clients’ alternative investments.

Risk warning: Investment is restricted to professional, high net worth and sophisticated investors who can demonstrate that they have sufficient knowledge and experience to understand the risks of investing. Risks include the potential loss of capital and limited liquidity. Investments are long term and it may not be possible to sell your investment prior to maturity. Past returns are not a reliable indicator of future performance.

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Investments. The facts of this fact sheet are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Investments delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Investments, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect. This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.

Fact Sheet – Private Equity on The Rise